Our Philosophy

Traditional stock picking strategies rely on the assumption that investors make decisions in a completely rational and objective manner, while taking time to synthesise all available information. However, this assumption is a fairytale – markets are not perfect and neither are humans!

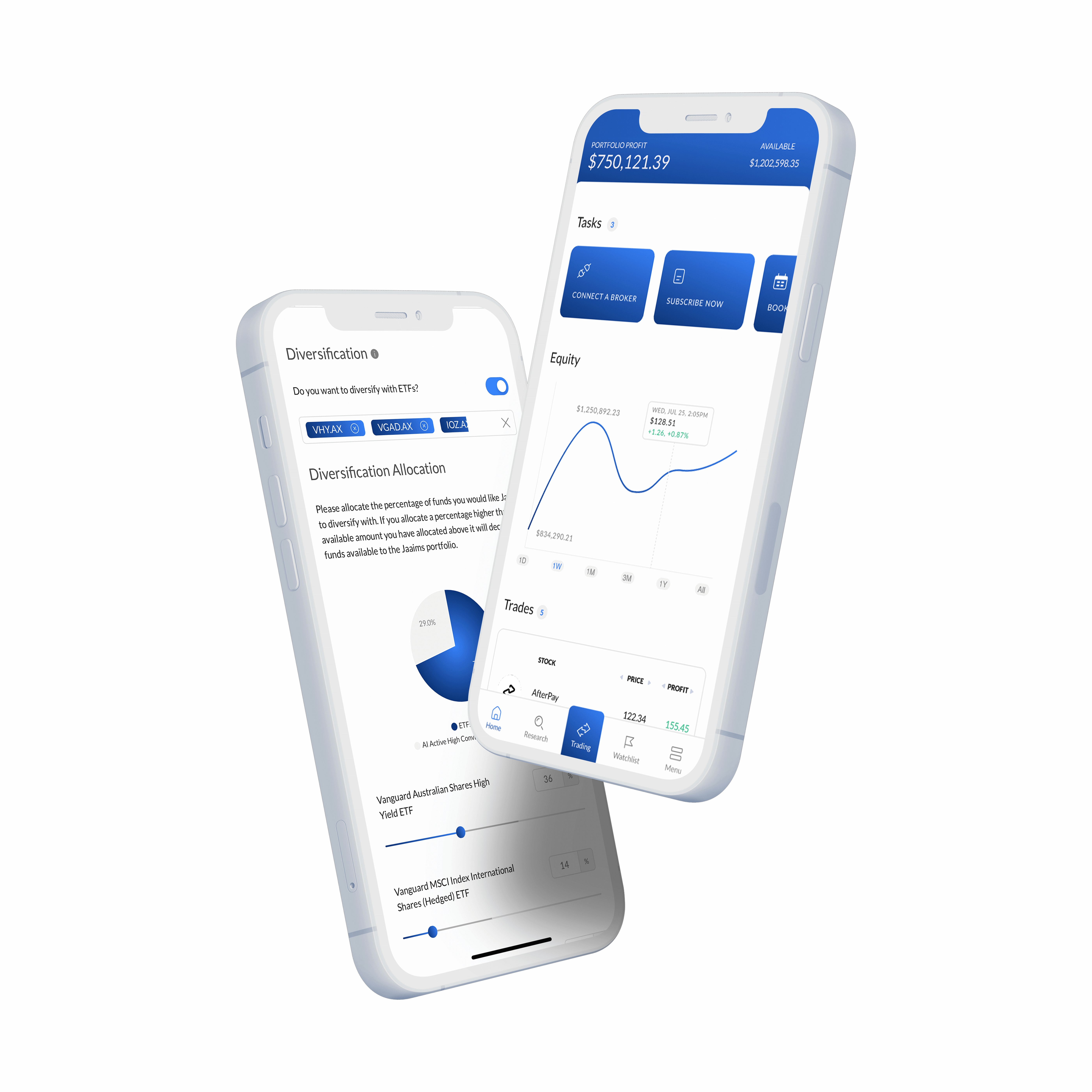

At Jaaims, this is the foundation of our investing philosophy. We have turbo charged the traditional fundamental investing strategy by using AI to analyse various data points rapidly and faster than any human can. By using advanced technologies and algorithms, our technology identifies undervalued stocks within trending sectors supported by strong market sentiment whilst utilising our market timing and risk management technology to optimise entry and exit. This approach enables our technology to increase and decrease exposure when opportunities are scarce whilst protecting and mitigating exposure risk.

Our Portfolios

Risks and Factors Affecting Performance

Jaaims relies on share markets to derive a return and is a long-only trading tool. As such returns are not guaranteed and you should be aware of the following risks and other factors affecting performance:

Jaaims relies on share markets to derive a return and is a long-only trading tool. As such returns are not guaranteed and you should be aware of the following risks and other factors affecting performance:

Investment Risk:

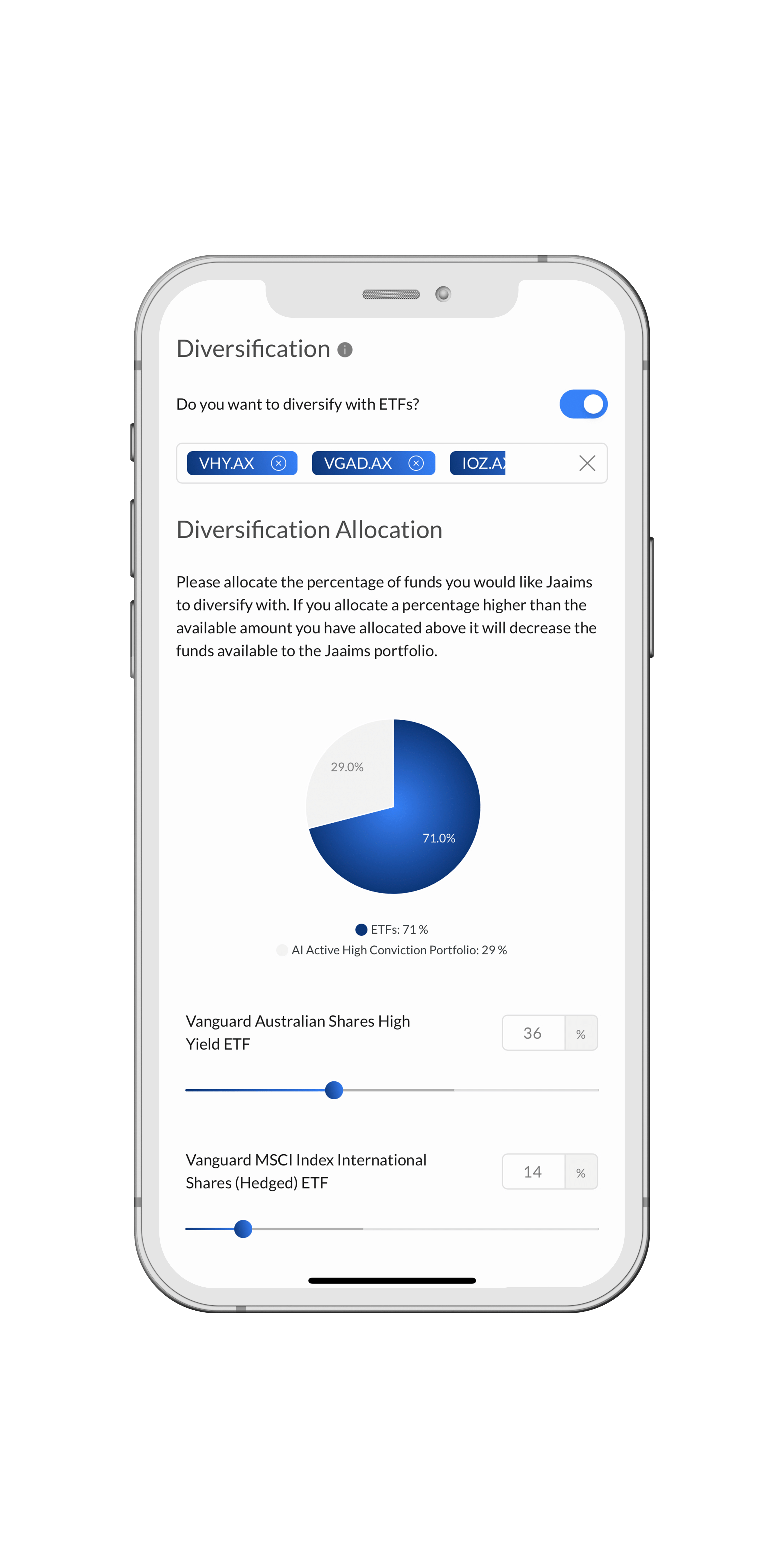

Share markets carry a risk of loss and do not always go up. As Jaaims is a long only strategy (i.e. it does not offer short-selling) it can only make a profit if stocks go up in price during the trade period. Jaaims seeks to manage investment risk by actively trading and updating recommendations every 15 minutes. The app may also retain high levels of cash where it does not see trades having a high likelihood of success which may serve to reduce losses that might occur if you were fully invested (e.g. via products such as managed funds or exchange traded funds).

Execution Risk:

There is a risk Jaaims will not be able to execute trades in a timely manner due to connection issues with your broker. We manage this risk by actively working through any issues with our connected brokers.

Concentration Risk:

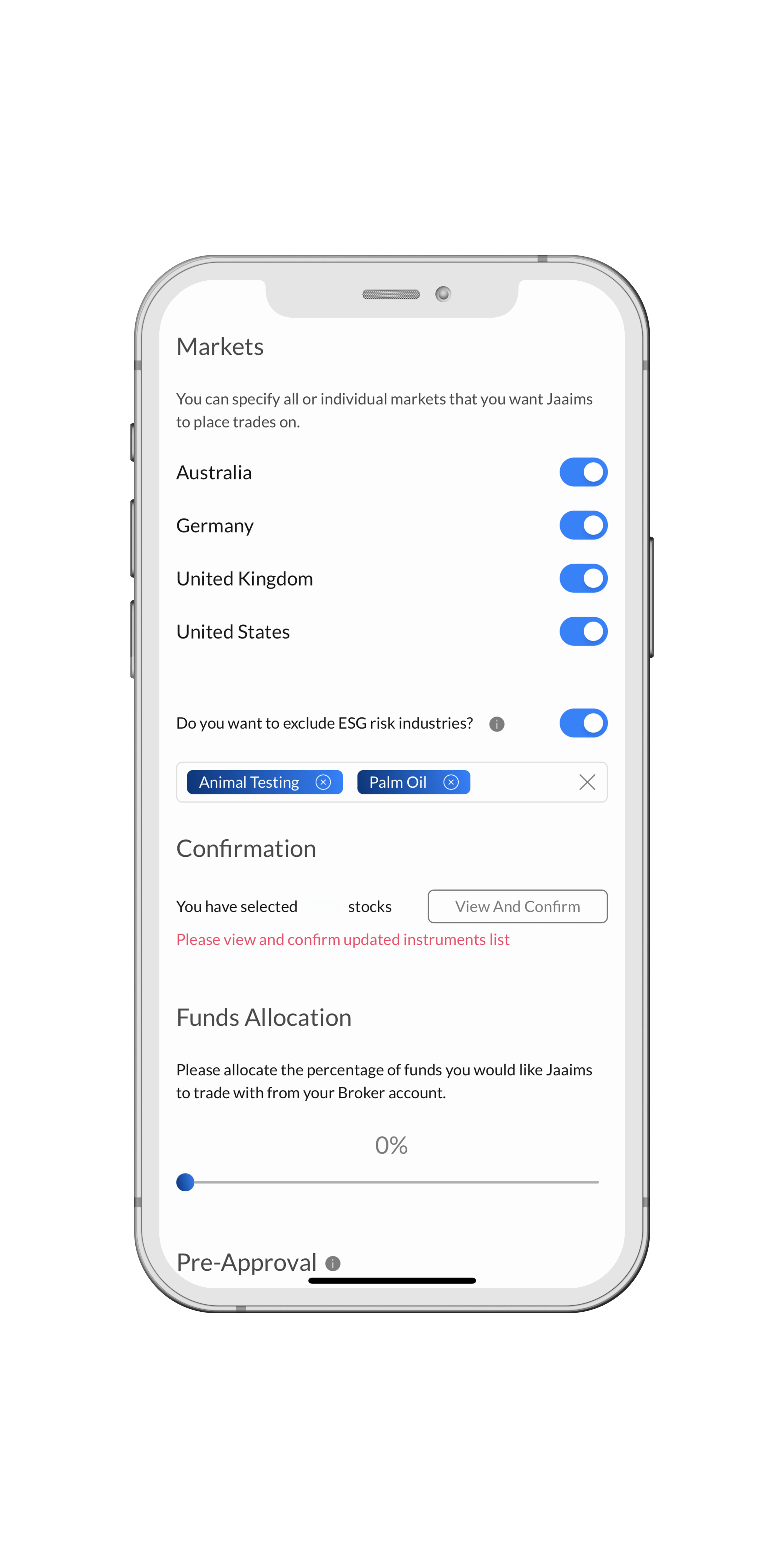

Users can select their preferred position size. Having a large position size relative to funds invested will mean a lower amount of trades and may result in higher volatility. In general we recommend a maximum position size of 5% of your portfolio but Jaaims gives you the ability to tailor your trading strategy to your own individual needs.

Stock Selection:

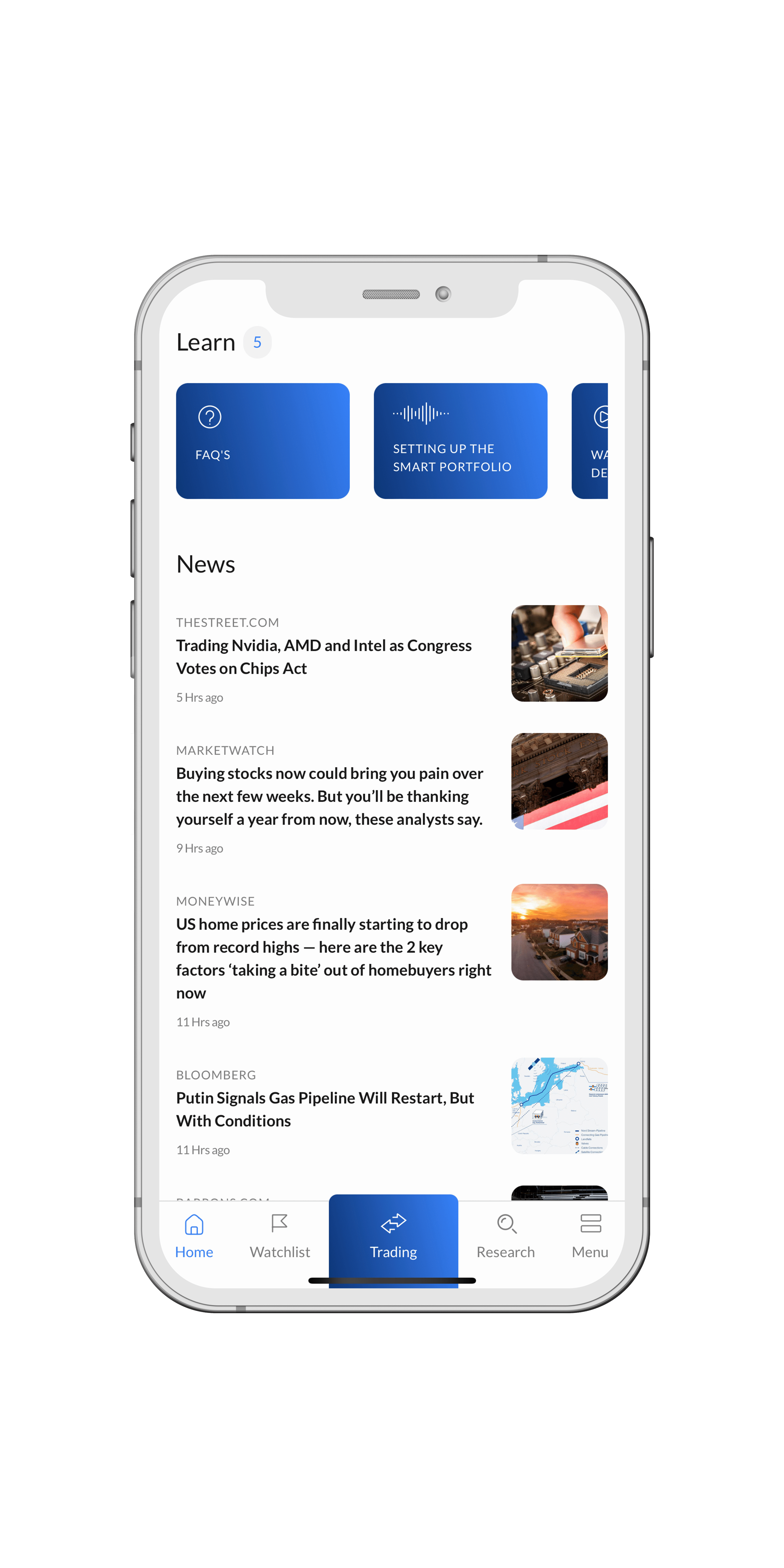

Performance for each individual user will depend on the stocks you select for Jaaims to trade. The Smart Portfolio feature offered in the Professional subscription will allow for the highest number of stocks to be selected in your portfolio to maximise your opportunity set.

Broker Selection:

Your choice of broker will affect your performance after costs. As Jaaims trades shares on international stock markets you should be aware of brokerage as well as foreign exchange costs.

Investment Risk:

Share markets carry a risk of loss and do not always go up. As Jaaims is a long only strategy (i.e. it does not offer short-selling) it can only make a profit if stocks go up in price during the trade period. Jaaims seeks to manage investment risk by actively trading and updating recommendations every 15 minutes. The app may also retain high levels of cash where it does not see trades having a high likelihood of success which may serve to reduce losses that might occur if you were fully invested (e.g. via products such as managed funds or exchange traded funds).

Execution Risk:

There is a risk Jaaims will not be able to execute trades in a timely manner due to connection issues with your broker. We manage this risk by actively working through any issues with our connected brokers.

Concentration Risk:

Users can select their preferred position size. Having a large position size relative to funds invested will mean a lower amount of trades and may result in higher volatility. In general we recommend a maximum position size of 5% of your portfolio but Jaaims gives you the ability to tailor your trading strategy to your own individual needs.

Stock Selection:

Performance for each individual user will depend on the stocks you select for Jaaims to trade. The Smart Portfolio feature offered in the Professional subscription will allow for the highest number of stocks to be selected in your portfolio to maximise your opportunity set.

Broker Selection:

Your choice of broker will affect your performance after costs. As Jaaims trades shares on international stock markets you should be aware of brokerage as well as foreign exchange costs.

Choose your plan and start

your free trial

Join now and start your 14-day free trial on our flagship Professional plan.